THE 1.6% SOLUTION

Maintaining progress on the United Nations Sustainable Development Goals - including reducing global carbon emissions over time to net-zero – requires about $40 trillion in incremental, dedicated private investment over the next decade. This note envisions how that funding might be achieved.

At one level, the private funding solution involves simple math. $250 trillion is now under the direct control of institutions like pension plans, insurance companies and sovereign wealth funds, as well as ultra-high-net worth individuals. If 1.6% of these assets were reallocated to targeted impact investment strategies per year, the UN SDG’s could be met.

An annual reallocation of 1.6% will seem low to some and excessively ambitious to others. Investors who are purely “return seeking” will likely reject this proposal for fiduciary reasons. But a growing number of investment products and strategies now offer verifiable impact as well as market-related financial returns. Investors who choose to allocate assets to these genuine “double bottom line” strategies could consider moving funds from traditional ESG indexed and investment grade corporate bond strategies to ESG Impact equity and investment grade green, social or sustainable linked bonds in the manners described below.

Framing the One-Point-Six Percent Solution™

In his “Roadmap for Financing the 2030 Agenda for Sustainable Development” UN Secretary General Antonio Guterres detailed three objectives, six action areas and fifteen specific asks. Objectives included: 1) aligning global economic policies and financial systems with the UN’s multifaceted 2030 agenda; 2) enhancing sustainable financing strategies and investments at both regional and country levels; and 3) seizing the potential of financial innovations, new technologies and digitalization to provide more equitable access to finance. Importantly, the UN 2030 agenda maintains alignment with the goal of net-zero emissions by 2050 and carries an estimated annual price tag of $2.5-3 trillion for emerging countries alone. A more recent report by the BlackRock Investment Institute estimates $1 trillion of targeted energy transition investments per year are needed. Netting these two reports and adding additional, unscheduled environmental and social spending needs in developed markets results in an incremental annual investment price tag of at least $4 trillion per year. Importantly, these funds will need to come from private sources.

The total volume of financial assets under the direct control of high-net worth individuals and global institutions, including sovereign wealth funds, pension plans, insurance companies, sovereign wealth funds, and central banks, now exceeds $250 trillion. To meet the most urgent challenges of our time, this group of asset owners would need to earmark 1.6% of their capital per annum for the next decade for explicit, dual impact purposes.

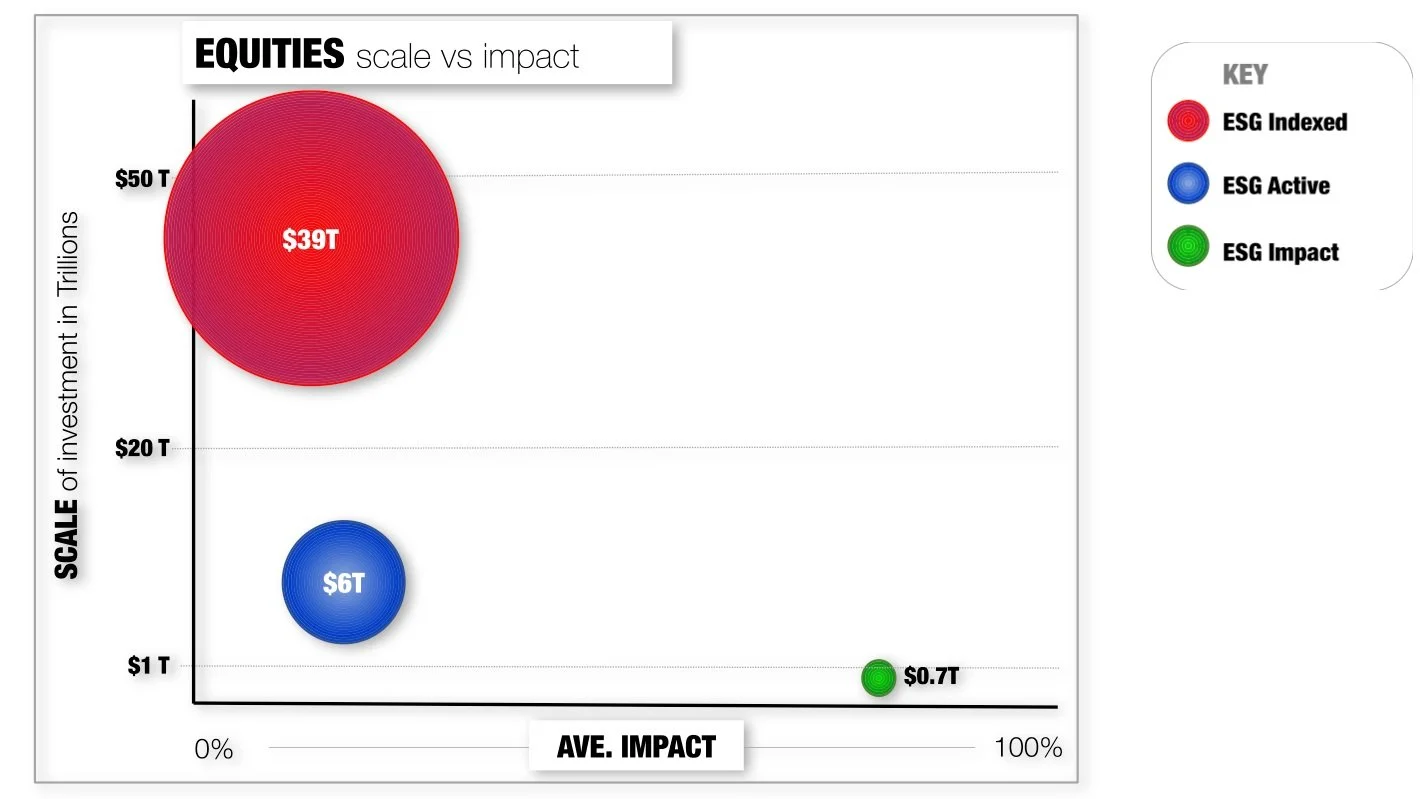

1.6% is simultaneously ambitious and plausible. Two possible funding sources may involve reallocating assets now dedicated to ESG Indexed and Investment Grade Bond strategies. These strategies and products already command more than $140 trillion in assets. An annual 2.5% reallocation from these pools alone would meet the $3.5 trillion/ 1.6% p.a. goal. These figures and assets are further described below, and visually represented in Figures W, X, Y and Z. The following definitions and taxonomies apply:

ESG Indexed are equity strategies which strive to deliver returns broadly in line with common equity or specially composed ESG indices using ESG-integrated analytics. The impact of ESG Indexed strategies on corporate behaviors are largely imputed from the cost-of-capital transmission (COCT) mechanism. COCT posits better behaving companies will have lower costs of capital, something which induces corporations to strive for better ESG outcomes. ESG Indexed strategies are more risk-mitigating than impact enhancing. While presumed to be positive, their specific impacts on corporate behavior are hard to measure.

ESG Active strategies strive to deliver total rates of return that may deviate significantly from common or specially composed indices. ESG Active strategies involve more concentrated stock positions, including explicit activist shareholder purposes. As some of these strategies intentionally seek to change strategic corporate behaviors aggressively, their social and environmental impacts may be more tangible than ESG Indexed strategies.

ESG Impact strategies differ from indexed or active strategies as they explicitly seek verifiable social and environmental impact as well as a financial return. ESG Impact strategies seek tangible, measurable environmental and social change as a primary objective. Their financial returns may be of equal or even secondary importance. Given social and environmental impacts are explicitly sought, their financial returns may be higher or considerably lower than ESG Indexed or ESG Active strategies.

Figure W represents these three different types of equity strategies in Return/ Impact space. Return is expressed as a percent of an index. Impact is represented as unknown/ unmeasurable vs. known/ measurable. Note these figures applies to both public and private equity asset classes.

The opportunity to derive more tangible impact from ESG equity strategies becomes apparent when one sees the relative magnitude of assets already dedicated to these types of strategies. Asset owners need to determine whether they want some portion of their investments to effect more verifiable change. If so, how much, and how those impacts will be measured become important.

As seen in Figure X, assets now dedicated to ESG Indexed strategies are a multiple of those committed to their Active and Impact counterparts: more than six times the volume of active strategies, and more than fifty times the volume of impact strategies. This suggests ESG assets are currently misallocated relative to their potential for optimal impact. For greater social and environmental progress, ESG equity allocations should be moved from indexed to active and/or impact strategies. As Figure W suggests, moreover, ESG Impact has a range of strategies whose performance could match or even exceed the return profiles of their indexed alternatives. Those seeking greater verifiable impact should expect more variable financial outcomes.

Figure X: ESG Equity Strategies: Size vs Knowable Impact

A similar, though in some ways even more compelling story exists in fixed income. Over the past five years, the issuance of loan and debt instruments whose proceeds are specifically dedicated to green, social or sustainable outcomes has grown exponentially, to well more than $1 trillion per year (see Chart Q). As with ESG Impact equity strategies, the proceeds of these instruments are used to advance specific environmental and social objectives in ways that can be tangibly measured and verified.